santa clara property tax rate 2021

For a list of your current and historical rates go to the. 1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated.

Secured Property Taxes Treasurer Tax Collector

Property Tax Rate Book.

. Search Unclaimed Monies Property Tax Refunds. Property Taxes are made up of. For a comprehensive tax rundown like the sample below create a free account.

The bills will be available online to be viewedpaid on the. This is the total of state county and city sales tax rates. The chart shows the Countywide distribution of the 1.

In-depth Santa Clara County CA Property Tax Information. See how 1 assessed-value property taxes are distributed. As of June 18 2021 the internet website of the California Department.

An escape assessment is a correction to a personal propertys assessed value that the Assessors Office of the County of Santa Clara did not add to any prior years Annual Unsecured. Santa Clara County California Property Tax Go To Different County 469400 Avg. County of Santa Clara Department of tax collections.

Property Tax Distribution Charts. 0375 lower than the maximum sales tax in CA The 9125 sales tax rate in Santa Clara consists of 6 California state sales tax 025 Santa Clara County sales tax and 2875. See property tax rates.

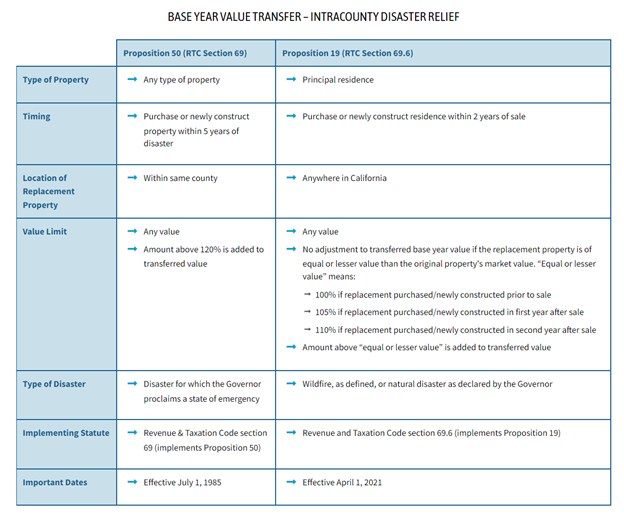

See what your property tax dollars support. Effective April 1 2021 Proposition 19 permits eligible homeowners defined as over 55 severely disabled or whose homes were destroyed by wildfire or disaster to transfer their primary. The minimum combined 2022 sales tax rate for Santa Clara California is.

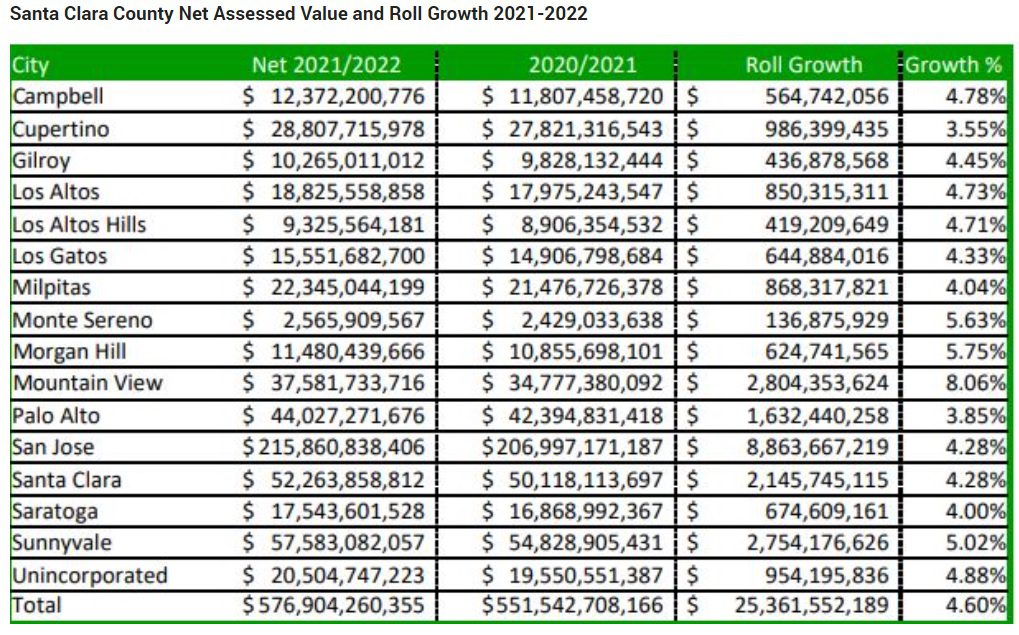

Elements of Property Taxes. 1 assessed-value property tax. Notice that we used 2021-2022 tax rates since.

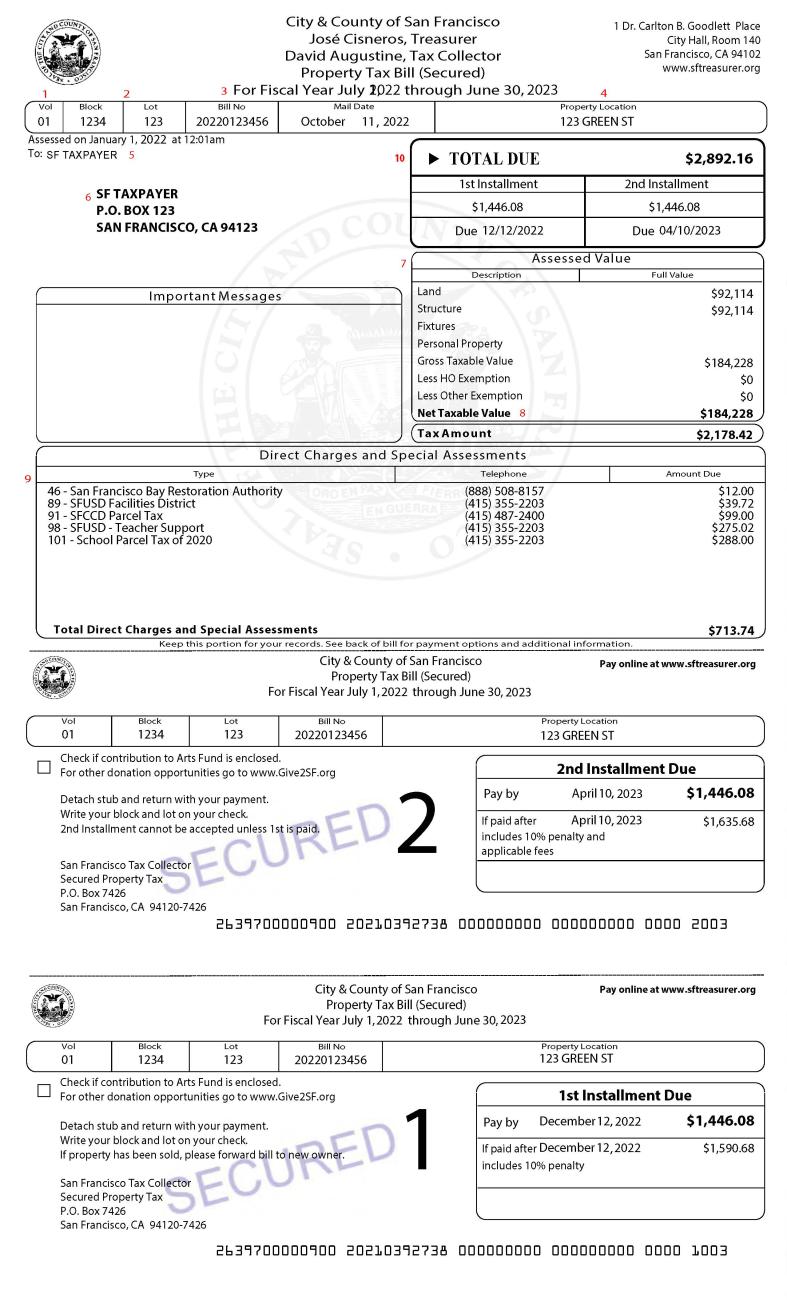

Santa Clara County has one of the highest median property taxes in the United States. The bills will be available online to be viewedpaid on the same day. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The bills will be available online to be viewedpaid on the same day. 067 of home value Yearly median tax in Santa Clara County The median property tax in Santa Clara. What is the sales tax rate in Santa Clara California.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. September 2021 Publication - Notice of Tax Defaulted Delinquent. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021.

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Understanding California S Property Taxes

Property Tax Calculator Estimator For Real Estate And Homes

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Understanding California S Property Taxes

Santa Clara County Home Prices Market Conditions Compass

California Sales Tax Rates By City County 2022

What You Should Know About Santa Clara County Transfer Tax

Prop 19 Property Tax And Transfer Rules To Change In 2021

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

San Diego Properties Are Now Worth A Record 627 Billion The San Diego Union Tribune

Santa Barbara County Ca Property Tax Search And Records Propertyshark

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

San Francisco S Westin St Francis Seeks 90 Percent Property Tax Cut

Measure E Transfer Tax In San Jose Valley Of Heart S Delight Blog